Author’s Note: This post moves from fun to management revolution in a hurry. Hold on!

Author’s Note: This post moves from fun to management revolution in a hurry. Hold on!

One of the things that I absolutely love about this time that we are living through is the constant and accelerating rewriting of the rules. How much fun is it to be engaged in a set of activities where what used to define success now defines failure and where your experience may be your own worst enemy? Someone should charge admission to this surreal game we are living!

It’s like playing my favorite board game, Monopoly, where the long-established rules of buy, build, rent and bankrupt your opponent shift ahead of your turn. Thought that Boardwalk was a good investment? Not anymore…by the time you land on it, it’s been sold off to a foreign player to raise funds to support infrastructure. Driving the car around the board. Sorry, your car company went bankrupt and unless you can bail it out, you’ll need to walk. Draw a Chance card and expect to advance to the nearest railroad? Forget it. The government now owns 80% of this industry and they can’t get the trains running. Bankrupt your partner. Heck no, that would be anti-competitive, so your partner just pulled off an interest free loan under the “too big to fail” act. (Hey Parker Bros, I’ve got dibs on the new “Ever Shifting Rules” version of your board game.)

One of my favorite business writers, Gary Hamel is back this week with his very relevant message that it is high time that we reinvented management and shed some of the late 19th century practices that persist. His focus this week is: The Three Forces Disrupting Management.

Hamel’s Three Discontinuities:

1. A wildly accelerating pace of change, an onslaught of new, ultra low-cost competitors, the commoditization of knowledge, rapidly increasing customer power and an ever-lengthening menu of social demands.

2. The invention of new, Web-based collaboration tools

3. The mash-up of new expectations that Generation Facebook will bring to work in the years ahead.

—

Yep. In this case, we didn’t need one of the world’s foremost management writers and thinkers to tell us what those of us running businesses have been painfully aware of for the past few years. Things are changing in front of us, even if our approaches are not changing to embrace and leverage the new dynamics.

Something’s gone horribly wrong with our pre-established convictions and our comfortable understanding of the old rules. There was no memo. The new rules are not written in stone anywhere, and in fact they are changing so quickly, that by the time you understand and write them down, they’ve changed yet again. Heck, a good number of firms and leaders never optimized under the old rules, and now look at what they are facing!

I work constantly with professionals and teams desperately trying to break free of the shackles of the old rules, the archaic premises and obsolete leadership practices that govern so many businesses. A good number of professionals get the fact that the game has shifted, yet organizations and leaders tend to hang onto the old premises. The obsolete and dangerous practices that still predominate, include:

- Rigid hierarchical leadership-it’s time to end the royal leadership model

- Silo structures-maybe the single most value destroying approach to organization

- Dysfunctional matrix approaches dominated by functional interests

- Ad hoc leadership identification and development practices (if any)

- Farenheit 451 type thinking about access to the internet and adoption of new methods of working and communicating

- Traditional strategic planning models that fail to take into account systems, constant change, the need to adapt, the difference between adapting and proacting etc.

- 1950’s HR practices (in many cases) that emphasize compliance and fail to focus on enabling performance

- An accountability paradox…those in charge are the least accountable

—

The Bottom Line:

Instead of a more traditional passing of the baton from one generation of business leaders to the next, I get the feeling that this period will be characterized by social and cultural revolution in business. It’s needed and in my opinion, appropriate.

The current situation will see record numbers of firms fail, and in many cases, they should and must. This painful cleansing will be just that a cleansing. The only way it doesn’t create a better landscape is if we through our governmental institutions destroy the ability to regenerate. That is an unfortunate but real possibility.

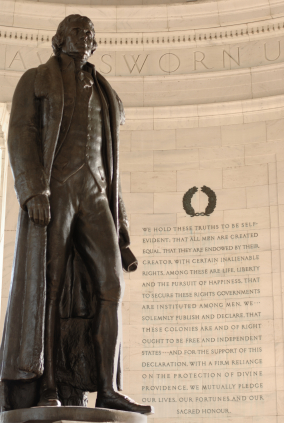

Jefferson’s perspective on the appropriateness and need for the French revolution shocked many of his contemporaries. I am right there with him. Forward progress will require significant business casualties and some shocking restructuring of what we view as conventional approaches to business.

I like Hamel’s thinking on management innovation and even revolution. I do think that his message is too soft. It’s time to rise up against the tyranny of hubris and the post Civil War management approaches that many leaders still cling to as their hold on power. There are many great people inside of even the most dysfunctional organizations that have some valid ideas on embracing the new rules. If you are a leader, its time to listen or beware the march of time and the villagers lighting torches!